The alt-cities: Why Tech, Finance, and Music chose Austin, Miami, and Nashville

Three months ago, my wife and I moved from San Francisco to Miami. I previously lived in San Francisco for over 23 years, where I started multiple companies and worked at companies like Sun Microsystems. Given the spate of people now moving, I thought it would be useful to aggregate the unique characteristics that have turned Austin, Miami, and Nashville into such hot destinations.

Globalization and network effects have produced centers of industry in mega-cities, such as finance in New York and technology in San Francisco. It takes a monumental event to displace an industry from a mega-city; the only such event in the modern era is the handover of Hong Kong to China, which shifted Asian finance to Singapore.

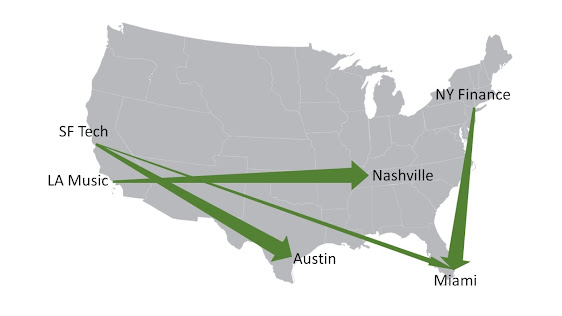

The coronavirus is now as significant an event as the handover of Hong Kong. Three alt-cities (alternative cities) for key industries are quickly emerging: finance from New York to Miami, technology from San Francisco to Austin, and music from Los Angeles to Nashville. There is also cross-pollination in these emerging centers. Much like New York started to have a tech scene, Miami has a rapidly burgeoning tech scene with great support from its mayor Francis Suarez.

Alt-cities require multi-faceted kindling to become viable competitors:

Key people

It's all about the key people. You can't move the center of an industry without moving key players. Years of attempts to kindle homegrown Silicon Valleys everywhere from the Silicon Prairie to Silicon Beach have fallen flat as a replacement to Silicon Valley because the key people stayed put.

Rather than going fully remote, key people are aggregating in cities where they will be able to network post-COVID. Austin has attracted well-known technology figures such as Elon Musk, Drew Houston, and Joe Lonsdale. Miami and South Florida have landed finance billionaires Carl Icahn and Paul Singer, as well as prominent technology investors Keith Rabois, David Blumberg, and Sherwin Pishevar. Nashville hosts well-known artists including Jack White, Miley Cyrus, and Taylor Swift, who rejected Los Angeles and helped shift Nashville from country to other forms of music. These cities are attracting free thinkers known to lead the way, leaving the impression that those left behind in the origin cities are clock-punchers at Google.

Prestigious companies

Alt-cities need well-known and prestigious companies to relocate or create significant outposts to help create an ecosystem. These companies help attract new talent to the area as well as transfers from other locations.

The Miami area has attracted numerous hedge funds, including Elliott Management, and even top-tier Wall Street firms such as Blackstone and Goldman Sachs are relocating key divisions to Miami. In Austin, Tesla is building its largest facility on the outskirts and Oracle is moving its headquarters there, joining outposts from Amazon, Apple, Facebook, Dell, and many other top-tier technology companies. Brand name Silicon Valley VC firms are closing their San Francisco South Park outposts and setting up shop in Austin. Nashville has sprung from its country music roots, with Warner, RCA, Sony, Universal, and other top-tier music labels expanding in the city.

Business-friendly

While New York City and San Francisco are mulling converting their emptied office buildings into residences, the alt-cities have seen an increase in office space demand and are quickly green-lighting new office space projects. Tesla's new facility in the outskirts of Austin was fast-tracked and is nearing completion.

The coronavirus highlighted how business-friendly a jurisdiction was in terms of using data and science to set rational re-opening parameters. With pandemic protocols in place, Tesla's factory was open in China, Boeing’s factories were open in Washington, and auto factories were open in Detroit, Alabama, and South Carolina. Tesla's San Francisco-area factory was one of the only auto factories in the world that was still closed, forcing Elon Musk to play a game of brinksmanship with local authorities, with the county’s assemblywoman sending Musk a vulgar missive.

Escaping increasingly bizarre taxes and regulations, it’s now no surprise for innovators to start a new hedge fund in Miami, a new tech startup in Austin, or a new record label in Nashville. Access to people and capital will be equivalent to the previous centers of industry.

Affordable suburban living

From the 1980s to the mid-1990s, cities suffered from high crime rates and numerous quality of life issues. New York City, San Francisco, Los Angeles, and some other major cities have recreated the environment of that era, with non-scientific pandemic restrictions that devastated local businesses and a penchant for placing the mentally ill directly in family-oriented, residential neighborhoods. These cities have stopped prosecuting many property and quality of life crimes, inevitably leading to bad quality of life and apathetic enforcement of more serious crimes.

The coronavirus has reset consumer expectations back to suburban living with the mental health benefits of living in greenspace. There has been an exodus from major industry centers to their suburbs and to the alt-cities. The alt-cities of Miami, Austin, and Nashville all offer car-friendly, suburban living, relatively cheap housing, and continual housing construction. With the acceleration of sustainable building materials and clean and cheap energy, the urban planning rationale to pack people into urban cores with mass transportation was already beginning to fray, and the coronavirus has sealed its fate.

Culture and openness

Miami is incredibly diverse, a nightlife capital of the world, has a booming art scene centered around Art Basel, and is almost as LGBTQ friendly as San Francisco. Austin and Nashville are both well known for live music and vibrant nightlife. All three offer farm-to-table restaurants and craft breweries, as artisans follow their clientele to new locations where they are unlikely to be arbitrarily shut down or face inordinately high insurance premiums.

New York City, San Francisco, and Los Angeles are increasingly recognized for only accepting a single, maximalist viewpoint with a rapidly shrinking Overton window that even excludes working with the defense industry. In Miami, half the people you meet are conservative and half are liberal, and there is an acceptance that there are alternative viewpoints. A diversity of thought -- rather than a single yet constantly shifting viewpoint -- is attracting "the crazy ones, the misfits, the rebels, the troublemakers, the round pegs in the square holes" to the alt-cities.

Low taxes and quality government

People are not moving solely for tax purposes. New York and California’s tax rates are only a few points higher than they were twenty years ago. However, once people decide to move, of course tax rate is a factor in choosing a destination. Florida, Texas, and Tennessee seemingly offer everything that California and New York offer: highways, streets, schools, police departments, fire departments, and such. All the government services one would expect are there, and none of the capital gains taxes that entrepreneurs and venture capitalists typically pay.

As comedian and political commentator Bill Maher recently noted, California is reminiscent of a 1970s Italy, with high taxes and terrible government services. In return for high taxes, one would expect to go to Hunter's Point, East Palo Alto, or East San Jose and see excellent schools and services for disadvantaged people. A hyperloop instead of a failed high-speed train. Fire mitigation and stable power to complement long term climate change goals. A boom in middle-class housing rather than a $700K median house price. California and New York are becoming bad versions of Singapore, with a wealthy technocratic elite, an immigrant servant class, and a collapsed middle class.

What’s next for alt-cities?

The alt-city trend has only just begun as legacy cities seem ideologically unwilling to waver on these characteristics. Other industries are starting to relocate, including the Los Angeles entertainment industry to Las Vegas by piggybacking on the porn industry, Seattle aerospace industry to Charleston by piggybacking on Boeing, New York art industry to Miami by piggybacking on Art Basel, Denver building a bigger technology sector by piggybacking on it broadcast/telecommunications base, and the New York retail fashion industry to Columbus by piggybacking on L Brands.

We are at a momentous intersection where numerous Hong Kongs are becoming Singapores.